Some Historical Perspective on Commercial Banks

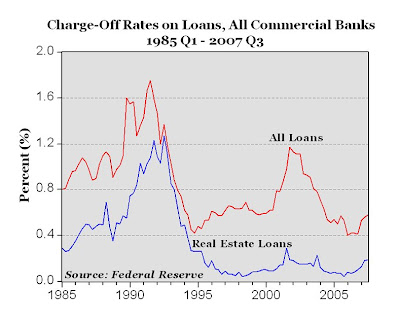

The charts above are based on Federal Reserve commercial banking data released on Monday and available here, with updated data on a) loan charge-off rates and b) loan delinquency rates through the third quarter 2007 for all U.S. commercial banks.

The charts above are based on Federal Reserve commercial banking data released on Monday and available here, with updated data on a) loan charge-off rates and b) loan delinquency rates through the third quarter 2007 for all U.S. commercial banks.As the charts show, despite all of the recent bad news and "gloom and doom" about the U.S. banking sector, the commercial banking sector might actually be surviving the subprime crisis quite well, at least so far. The charge-off rates for all bad loans (0.60%) has increased recently (top chart), but is about half the 1.2% rate in 2002, and about 1/3 the 1.75% rate in 1991. The charge-off rate for real estate loans (.19%, or only about 2 properties per 1,000) in the third quarter 2007 is almost half of the .29% rate in 2001, and less than 1/6th of the 1.2% rate in 1991.

Likewise, loan delinquency rates have increased recently (bottom chart), but are still far below the rates of the late 1980s and most of the 1990s.

On a previous CD post, I reported that not a single U.S. bank failed in either 2005 or 2006, and only 3 banks have failed in 2007. The loan charge-off and delinquency rates for U.S. commercial banks through the third quarter of 2007 indicate that our banking system is surviving the subprime crisis, without any danger of pending collapse.

Bottom Line: The U.S. banking system is probably stronger and more stable than most people give it credit for. Empirical data on bank charge-off rates and delinquency rates, at least through the third quarter 2007, suggest that banks are probably doing better than most people think.

3 Comments:

I don't think the write-downs banks are taking from mortgage backed bonds are going to show up in those statistics as real estate charge offs.

even if you double the historic charge off rates the write-downs are way excessive. those of us who lived through the last real estate crisis will be buying financials right now

stumbled upon this just now. great analysis commenters!! well done!!

Post a Comment

<< Home